If you are part of that 98%, that means whatever your industry is, you are sure to have some tough competitors, and it takes a lot of time and effort to be first in your niche. That is why it makes sense for you as a business owner to spend more time running a business and less time doing accounting and bookkeeping-related tasks, and the right software can save much time.

Below you will find an overview of the most popular bookkeeping software for Canadian corporations, and we have experience working with all software in the list below. Whatever software you choose, our accounting company can help you with the year-end corporate tax return, HST filing services or bookkeeping.

Table of Contents

Bookkeeping software: Top questions to answer before doing research

List of accounting & bookkeeping software

Microsoft Excel

QuickBooks Online

Wave Accounting

Sage Business Cloud Accounting

Xero

Freshbooks

Zoho Books

Our recommendations

FAQ

The best way to handle accounting for your business

Nowadays, many bookkeeping software provides a great alternative to a spreadsheet. Such software not only gives you information on your income and expenses but in addition, it also provides you with valuable data you can use for business planning and wise future decision-making.

So, as the world rapidly transitions from traditional to digital business operations, accounting & bookkeeping software has never been this relevant.

It is an intelligent investment for small businesses because it provides programs that automate your processes, helping you devote more time and attention to scaling your business.

There are many benefits to switching over to a bookkeeping software program that will help you streamline your bookkeeping. This article covers some of the most popular Canadian accounting & bookkeeping software and gives you a starting point of what is available and what features you can find there.

Feel free to jump to the list of bookkeeping software, but before you do it, let’s go over some important questions you need to answer yourself, they may help you better understand what your needs are and what allows you to filter irrelevant options.

Bookkeeping software: Top questions to answer before doing research

What’s your budget?

How much are you willing to spend on a bookkeeping tool? Most software has varying pricing schemes depending on the features you may find there. They range from free plans to hundreds of dollars per month. When looking for the correct package, check if a yearly subscription is available; usually, it can give you significant savings, and you will likely use the same software for years to come. You can also check the product websites or contact support to see if they offer promos or discounts.

What’s the size of your business?

Are you a one-person team, or do you employ many employees and need a payroll for your company? Take your growth into consideration when making a choice. Get an accounting tool that you can easily upgrade once your business is booming or you start hiring multiple new workers.

Which features can help you most?

When looking for the best bookkeeping software, start with the features and services. Some tools may have invoicing features but no payroll service. Others may have an unlimited number of users but no inventory management. You have to decide what features you need for your small business and pick the tool that offers the most solutions within your budget.

How are your bookkeeping skills?

If you only have beginner skills in accounting & bookkeeping, try to find user-friendly software with an in-app tutorial system and guide. If you are already familiar with bookkeeping work, you can choose a more advanced tool to accommodate your needs.

List of bookkeeping software for small business

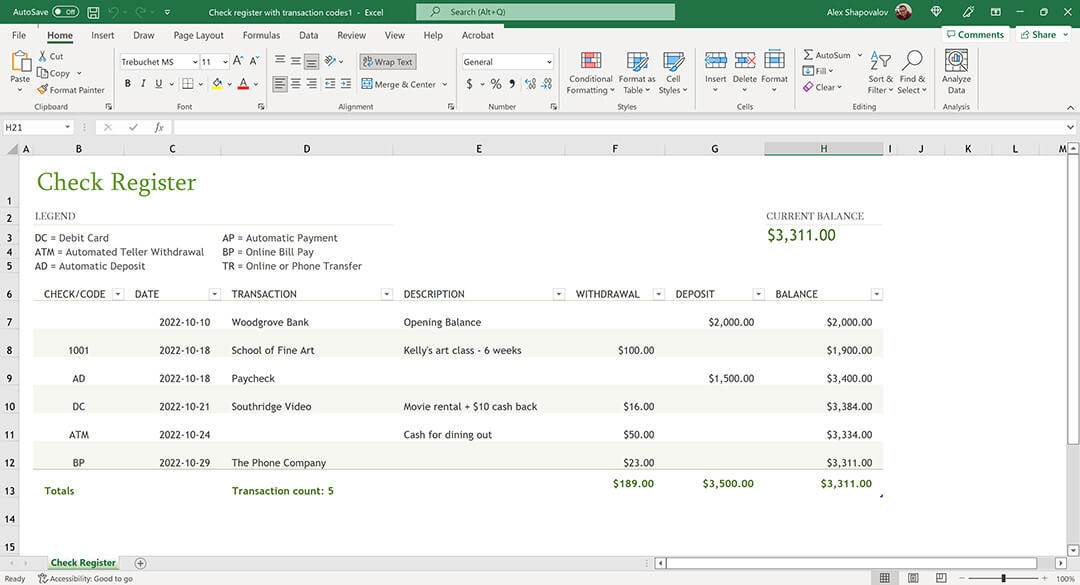

Microsoft Excel

So while Excel may be a good tool for your home budget, it is not the best bookkeeping tool for your business.

Pros:

- Easy to start without prior experience

- A flexible tool with many customization options

Cons:

- It became difficult to manage once the business grows

- Your accountant may have difficulty understanding and interpreting the data in Excel

Intuit QuickBooks Online

QuickBooks is one of the most comprehensive accounting & bookkeeping software on the market, so it’s no surprise that

it ranks high on our list. Its numerous features make it an excellent choice for small and large business operations.

Developed by Intuit, a leading Canadian software company specializing in financial software, QuickBooks Online is a

cloud-based accounting system you can access through a mobile app or web browser.

Small business owners and accountants providing services for small businesses commonly use this software because of its

fluid and efficient accounting features. In addition, you can conveniently access all of its featured accounting & bookeeping tools

in one central dashboard.

QuickBooks online is a software loved by all accountants. However, it has a significant downside; it is not free, so

if you are on a budget, please keep reading. We have some free options available down below.

QuickBooks offers a 30-day free trial and three subscription options. They are as follows:

- EasyStart at $20 per month

- Essentials at $40 per month

- Plus, at $60 per month

Most of our clients use Quickbooks online Essential package.

Pros:

- QuickBooks is the most comprehensive accounting software available.

- It has a user-friendly interface that’s great for novice users.

- It allows you to track job expenses efficiently.

- Accept payments online (Visa, Mastercard, ApplePay, Discover)

- Best payroll features (Direct deposits, Automated tax filing, Employee portal)

Cons:

- The software is a bit pricey compared to other options on the market.

- The payroll add-on is an extra $20/mo +$3/employee/mo

- After subscription cancellation, you can access your records only for a year

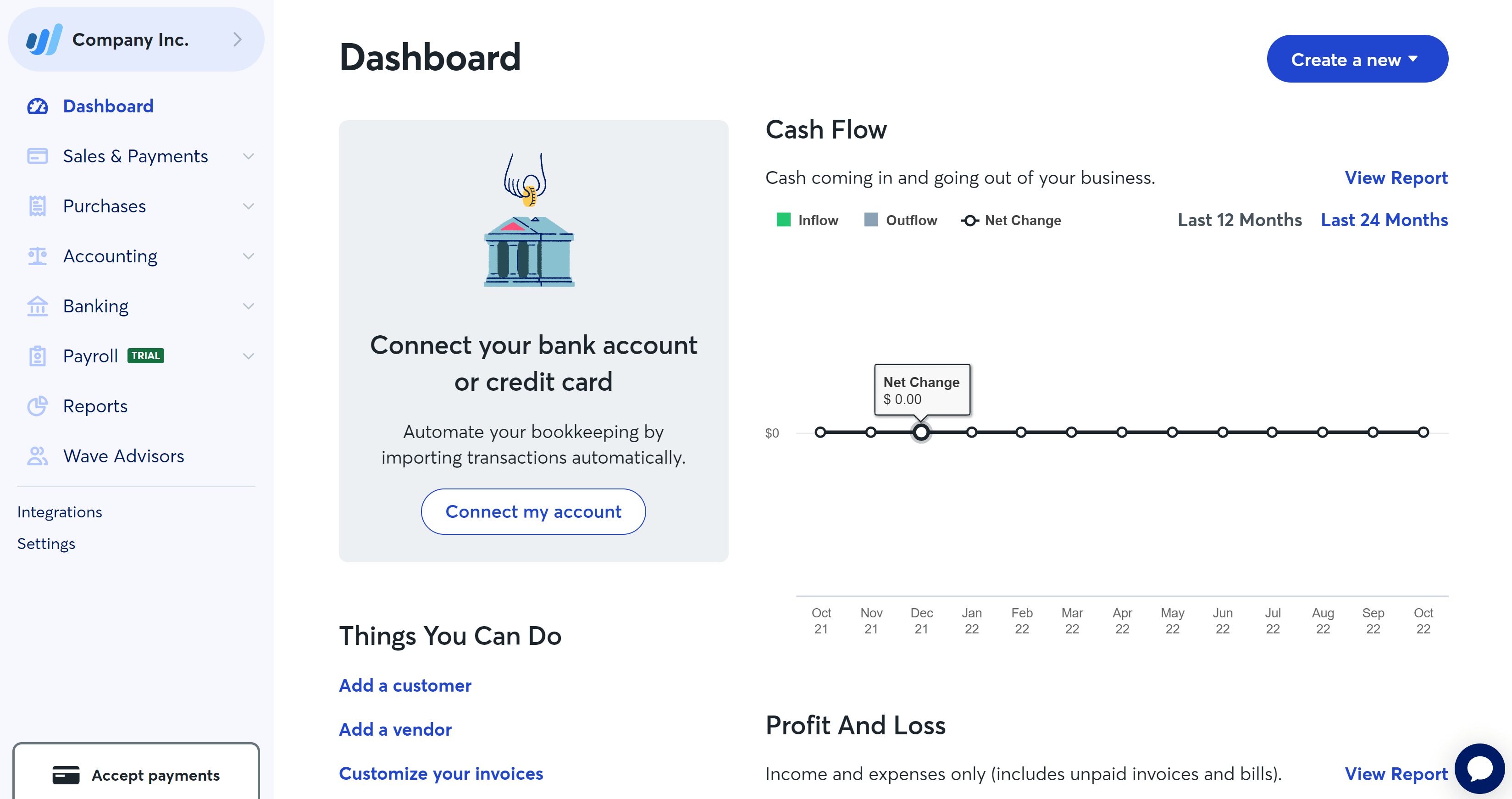

Wave Accounting

It’s easy to set up, and even employees with no accounting experience can learn and manage it. Wave accounting helps you to charge your clients online and process Mastercard/Visa/American Express payments. However, they charge a small fee per transaction. In addition, growing companies with employees have to pay for the Payroll package, which is an extra add-on.

Pros:

- Wave Accounting is free software.

- Perfect for small businesses with no employees

- It’s easy to set up and use, which means less frustration if you’re new to an accounting software package.

- It’s very user-friendly and has several helpful features like report templates, reminders, and invoicing options.

Cons:

- Payroll is a paid add-on.

- Credit card processing fees.

- No time tracking option

- Lacks inventory management

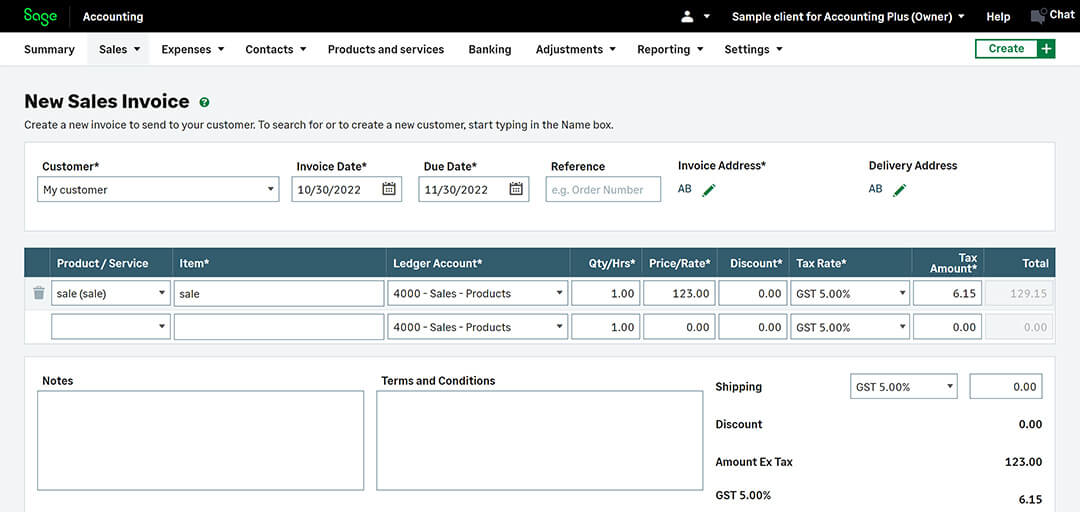

Sage Business Cloud Accounting

If you’re looking for a simple solution to set up and use, then Sage Business Cloud Accounting might be the right choice. The software has two options: desktop with cloud storage and online application. It makes it ideal for business professionals who regularly travel and do not always have internet access and allows them to access their data without an internet connection. The software has standard accounting features, such as invoicing, payroll, and payments. Furthermore, it integrates with the Microsoft 365 platform, so if you are already using Microsoft 365, you may get extra benefits from choosing Sage 50cloud Accounting.

Because this bookkeeping software has all the capabilities of QuickBooks Online, but for the half price, it might be worth checking out as well.

Pros:

- A cloud-based system makes setup easy with no installation required.

- Sage Business Cloud Accounting is user-friendly and allows you to create invoices and invoice customers quickly.

- You get 24/7 support from Sage.

- College students who study business accounting learn Sage, so finding an accountant with Sage Accounting experience would be easy.

- It is a more affordable option compared to Quickbooks.

Cons:

- It may be more complicated to use and less intuitive.

- You may spend more time learning this software compared with other options.

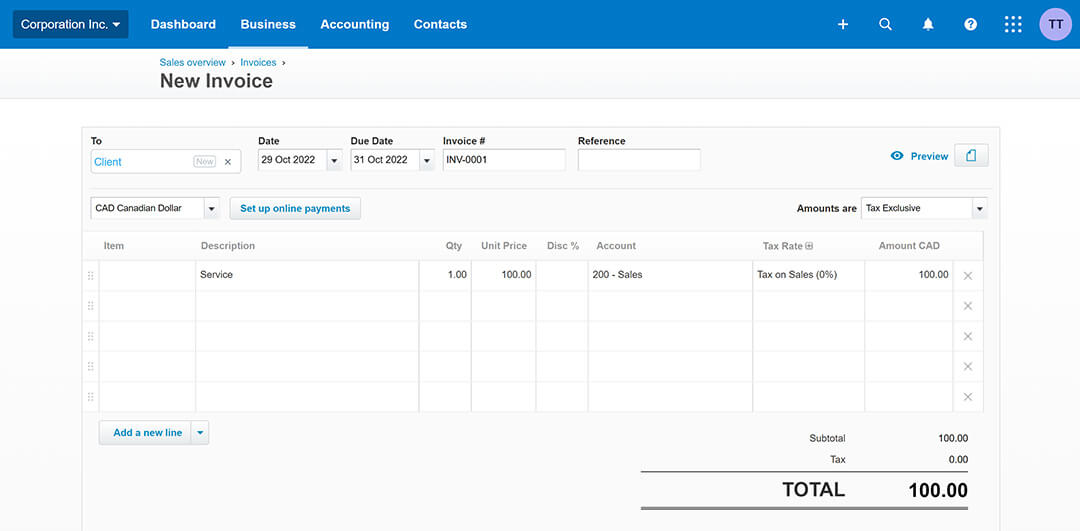

Xero

Perfect for micro-businesses, the software has a straightforward interface making it easy to set up and navigate. Headquartered in New Zealand, Xero has become a favourite bookkeeping software in the UK, US, Australia, and Canada.

Xero quickly gained ground by offering reliability, ease to use, and powerful features at a reasonable price. The company targets small business owners or companies that require critical accounting functions and doesn’t include many advanced features; for example, the payroll feature is minimal. As a result, Xero can be great if you need an accounting package that works well on its own without any extra bells and whistles.

Pros:

- Flexible pricing plans make this software accessible for businesses with smaller budgets.

- Xero has received numerous awards and an “A+” rating from the Better Business Bureau, so you can be sure it’s reliable and safe to use.

- Its simple interface is handy for both novice and experienced users.

- Designed for users without an accounting background, it is one of the most user-friendly software.

Cons:

- Xero isn’t the best package if you’re looking for a comprehensive accounting system.

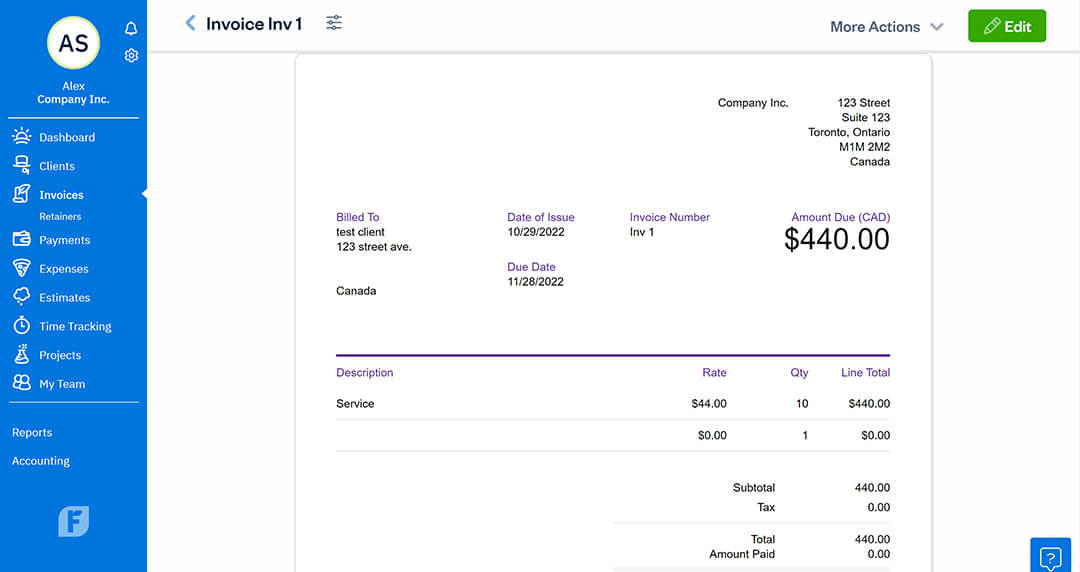

Freshbooks

Although it mainly facilitates quick and easy invoicing, the software is also great for basic bookkeeping, billing, expense tracking, and time tracking. In addition, it has a user-friendly interface and is relatively affordable too.

Freshbooks has three different plans you can choose from depending on the size of your business and its accounting needs.

Freshbooks’ unique feature is that you can customize your invoices to complement the look and feel of your branding, and it is one of the software’s best-selling points. In addition, Freshbooks integrates with a massive number of 3rd party software, such as Shopify and Stripe, so if you have a sizeable online presence, it makes sense to look into Freshbooks offerings.

However, it’s not the most comprehensive accounting package, so don’t expect to perform payroll or taxes directly from FreshBooks.

Pros:

- Easy to set up and affordable;

- FreshBooks is very user-friendly.

- Best software for creating invoices

Cons:

- Accounting features are limited.

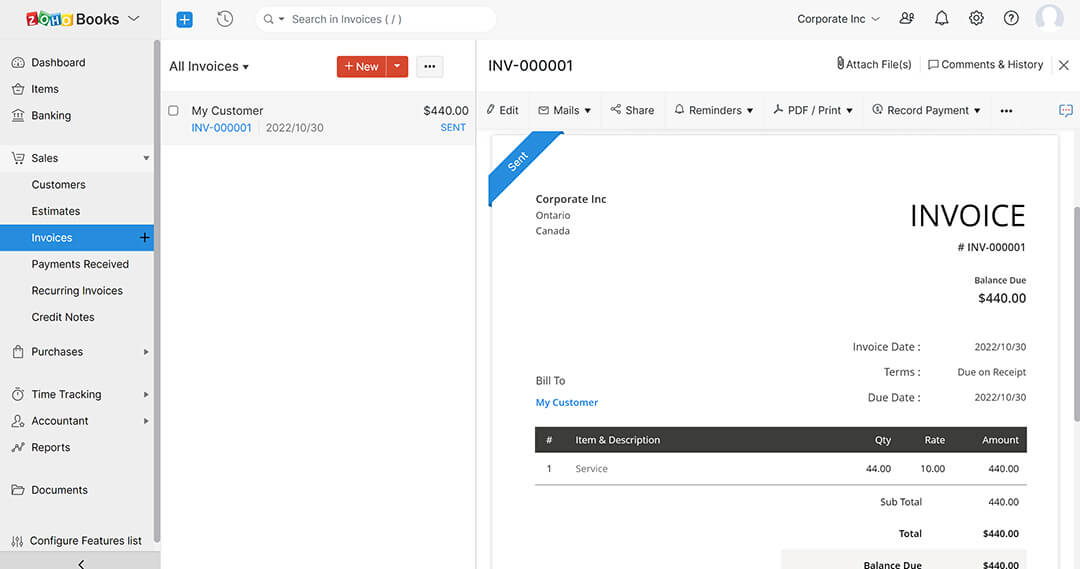

Zoho Books

Zoho’s primary advantage is its ecosystem, where many other Zoho applications can be integrated and managed from the same account.

Besides accounting software, Zoho provides Mail, CRM, Marketing and other business tools.

It features automated processes such as payment reminders, notifications for certain transactions and workflows, and report scheduling.

Pros:

- Zoho Books is very affordable and easy to set up.

- Other Zoho software has integration with Zoho Books.

Cons:

- Zoho is not a Canadian company, so it may need extra customization for Canada, for example, setting up the correct taxes

Our recommendations

Best Free App: Wave

Wave is free accounting & bookkeeping software that offers all the crucial features for your accounting needs. It provides unlimited bank and credit card synchronization, expense tracking and management, billing, report generation, receipt scanning, invoicing, and a guest collaborators option in one free account. It is ideal for freelancers or service-based small businesses that do not need inventory tracking or payroll generation.

Key Features:

- Complete accounting service, receipt scanning, and invoicing.

- Add multiple businesses in one account

- Mobile app feature

- Unlimited free users in one account

Best Overall App: Quickbooks Online

Intuit’s QuickBooks Online is the most commonly used online accounting software for small businesses – and with good reasons. Besides the all-in-one accounting & bookkeeping functions, it also has a user-friendly dashboard where you can access all features.

Key Features:

- Highly recommended by accounting professionals

- Mobile app feature

- Access anytime, anywhere

- Easy integration with third-party apps

Best For Startups: Xero

If you are a startup looking for a simple, clean interface that does all the accounting work, Xero is for you. More than two million people trust this tool for their accounting needs so that they can rely on it for their small businesses or startup.

Key Features:

- Most user-friendly accounting software

- Basic inventory management

- Access anytime, anywhere

Frequently Asked Questions

Do I still need an accountant if I purchase a QuickBooks Online subscription?

The best way to handle accounting for your business

A reliable accounting system helps you track and monitor your business performance and clearly understand your profitability. But with so many options available in the market right now, a small business owner might need help finding the right tool. We have discussed different accounting software that you can use. You may select any of them depending on your budget and needs.

But suppose you have a budget and do not want to spend time researching. In that case, we highly recommend QuickBooks Online Essential package. It is a very easy-to-use accounting software backed up by one of North America’s most reputable software companies – Intuit.

Nevertheless, you still have to hire an accountant to file your corporate taxes and perform bookkeeping. The software we reviewed does not replace a business accountant with years of experience with reporting, tax calculation and filing to CRA. You must file your HST return and corporate taxes regularly, and you can’t do it without prior experience.

Our company provides a full range of accounting, bookkeeping and taxation services for small business owners and individuals. Feel free to contact us to learn more and become our client.

Contact us today, and get professional help!

We offer a no-obligation phone consultation where we explain what we offer and how our services will help you focus on running your business.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Related articles

Small Business Bookkeeping: The Definitive Guide for Business Owners

In the article, Anna gives business owners an ultimate guide to small business bookkeeping, covering all aspects of bookkeeping for corporations. The blog post covers all you need to know about bookkeeping, whether you are doing it yourself or hiring a professional. Bookkeeping is an integral part of any small business, and it is essential to do everything right to avoid complications during the tax period.

Bookkeeper Interview Questions & Answers

Best Way to Manage Bookkeeping For Startups

Anna Grigoryan is a professional corporate accountant who provides accounting, bookkeeping and tax services to Small Business owners and individuals. She has more than ten years of professional experience in public accounting and a bachelor’s degree in Business Accounting. Anna is the CEO of Taxory, an accounting firm in Toronto area.