In today’s fast-paced business world, time is a precious resource, and small business owners constantly seek ways to streamline their financial processes. One area that can significantly benefit from simplified procedures is HST tax reporting, and that’s where the HST Quick Method comes in. Designed by the Canada Revenue Agency (CRA), this alternative approach to calculating the Harmonized Sales Tax (HST) simplifies tax remittance for eligible small businesses, saving time and effort.

The HST Quick Method offers a simplified accounting technique, enabling businesses to remit their HST without getting entangled in the complexities of input tax credits. With this method, you can significantly reduce the time spent on HST calculations, which allows you to focus on the more critical aspects of your business. In addition, you save substantially on the taxes you pay to CRA.

Fastest way to file your HST tax return

There is a fast and effortless way to file your HST taxes. If you want to save time, contact our team, and we will file your HST tax return.

Table of Contents

What is the HST Quick Method?

HST Quick method and Input Tax Credits (ITCs)

Eligibility criteria for HST Quick Method

Saving time with HST Quick Method

Saving money with HST Quick Method

Tax rates for the HST Quick Method

Tax credit from the first $30,000

Switching between HST Quick and Regular Methods

HST and foreign income

Disadvantages of using the Quick method

GST/HST Calculation form

Frequently Asked Questions (FAQ)

The Ultimate Solution for HST tax return

This article will explain HST Quick Method in-depth, outlining its benefits, eligibility criteria, and steps for successful implementation. By the end of this article, you’ll be well-equipped with the knowledge to determine whether the HST Quick Method is the right choice for your business and how your business can maximize its potential. So, let’s dive into simplified taxation and explore the HST Quick Method in detail.

What is the HST Quick Method?

The HST Quick Method is a simplified accounting approach introduced by the Canada Revenue Agency (CRA) for eligible small businesses to calculate and remit the Harmonized Sales Tax (HST). This alternative method saves time and reduces the complexity of tax reporting and paperwork.

Under the HST Quick Method, businesses still charge their clients the regular HST tax rate (for example, the HST rate in Ontario is 13%). Yet, when businesses remit HST to the CRA using the HST Quick Method, they do not pay the whole amount they charged from clients, but a difference between the full rate and HST Quick Method remittance rates (that depends on the province and type of business).

Here is an example of the HST Quick Method calculation for an auto repair shop in Ontario:

Assuming you provide a service that costs $1000, the standard HST rate in Ontario is 13%. The total amount charged to your client would be $1000 (service cost) + $130 (13% HST) = $1,130.

Using the regular HST method, you must remit the entire $130 HST to the Canada Revenue Agency (CRA). However, with the Quick Method, the calculation is different. The Quick Method rate for an auto repair shop in Ontario is 8.8%.

To calculate the amount you need to remit to the CRA using the Quick Method, multiply the total amount charged to your client, including HST, by the Quick Method rate: $1,130 * 8.8% = $99.44.

Now, subtract the Quick Method remittance amount from the original HST amount: $130 – $99.44 = $30.56. You can keep this $30.56 as a benefit of using the Quick Method.

HST Quick method and Input Tax Credits (ITC)

The critical advantage of the HST Quick Method is that businesses don’t need to track the HST they collect on each sale or the Input Tax Credits (ITCs) they can claim on their business expenses, simplifying the tax reporting and making it more manageable for small businesses.

However, when you buy capital expenditures, you are still eligible to claim ITC under the following circumstances:

- Real property purchases and improvements: You can claim ITCs for buying real property and any improvements made.

- Capital property purchases and improvements: ITCs can be claimed for purchasing capital property (excluding real property), such as computers and vehicles, and any improvements made to these items.

- Purchases made before your Quick Method election: If the GST/HST became payable before you elected the Quick Method and the time limit to claim ITCs has not expired, you could still claim them.

- Goods sold by auctioneers or agents: If an auctioneer or agent sells goods on your behalf and is responsible for accounting for the tax, you can claim ITCs for these goods.

Nevertheless, the HST Quick Method may not be suitable for every business, particularly those with significant HST paid on their business expenses. Such companies may be unable to claim ITCs for most of these expenses.

Before choosing this method, you should check eligibility criteria, potential tax savings, and impact on cash flow.

We advise you to discuss eligibility criteria with our accountant. When you become our client, we will be happy to explain all nuances and provide the best options for your company.

Eligibility criteria for HST quick method

To be eligible for the HST Quick Method, your business should meet specific criteria set by the Canada Revenue Agency (CRA). These criteria are:

- The business’s annual worldwide taxable revenue (including that of any associates) must be $400,000 or less in the last four consecutive calendar quarters.

- The business is a Canadian corporation with a permanent establishment in Canada and was active during the last year.

- The business must not have been revoked from the HST Quick Method within the last 365 days.

- The corporation is not on the list of ineligible businesses.

Businesses ineligible for the quick method include:

- Companies offering accounting, bookkeeping, financial consulting, tax consulting, or tax return preparation services as part of their commercial activities.

- Companies providing legal services (lawyers).

- Financial institutions: banks, credit unions, insurance companies, trust companies, etc.

- Charitable organizations.

- Public institutions.

- Non-profit organizations receive at least 40% government funding in a given year (known as qualifying non-profit organizations).

- Municipalities or local authorities.

- Non-profit universities, public colleges or school authorities.

- Hospital authorities, operators, or suppliers.

It’s essential to assess your business’s eligibility based on these criteria before opting for the HST Quick Method. If your business is eligible, you must complete Form GST74, “Election and Revocation of an Election to Use the Quick Method of Accounting,” and submit it to the CRA to begin using the HST Quick Method.

HST tax strategy and planning

At Taxory, our expertise in HST allows us to offer comprehensive HST filing services for all our corporate clients. We stand by your side throughout every stage, ensuring minimal time investment on your part. Going above and beyond traditional accounting firms, we deliver tailored HST tax strategies designed to optimize your tax obligations and keep your business financially efficient.

Saving time with HST Quick Method

The HST Quick Method saves time and reduces paperwork for eligible small businesses by simplifying the process of calculating and remitting Harmonized Sales Tax (HST). Here’s how it achieves these objectives:

- Simplified HST calculation: Instead of tracking the HST collected on each sale and the Input Tax Credits (ITCs) on eligible expenses, businesses using the HST Quick Method apply a predetermined remittance rate to their total taxable supplies (including HST). This rate is based on the business’s industry and province, as HST rates vary across Canadian provinces. This streamlined calculation process makes determining the amount of HST owed to the CRA easier.

- Reduced record-keeping: Businesses using the HST Quick Method do not need to maintain detailed records of HST collected on sales and ITCs on expenses. The remittance rate already accounts for the HST collected and a portion of ITCs, simplifying record-keeping and reducing the administrative burden associated with tax reporting.

- Easier tax preparation: Since businesses using the HST Quick Method only need to apply a single remittance rate to their taxable supplies, preparing tax returns becomes more straightforward. It can save time during tax preparation and make it easier for small business owners to manage their tax obligations.

- Lower risk of errors: With fewer calculations and less detailed record-keeping, the HST Quick Method reduces the likelihood of mistakes in HST remittance, which can help small businesses avoid potential penalties or interest charges resulting from inaccurate tax reporting.

Overall, the HST Quick Method simplifies tax reporting for eligible small businesses, allowing them to focus on their core operations and save time on administrative tasks. However, it’s essential to evaluate whether the HST Quick Method is suitable for a specific business and to ensure that the company meets the eligibility criteria before opting for HST Quick Method.

Saving money with HST Quick Method

The HST Quick Method can help eligible small businesses save money on taxes in several ways. While it may not always result in significant tax savings for every business, it can be advantageous in certain situations. Here’s how the HST Quick Method can lead to potential tax savings:

- Lower remittance rate: The HST Quick Method uses a predetermined rate typically lower than the standard HST rate. This rate accounts for the HST collected on sales and a portion of the Input Tax Credits (ITCs) on expenses. Businesses using this method might remit less HST to the CRA than the standard method.

- Reducing accounting fees: The HST Quick Method reduces the administrative burden of tracking HST collected on sales and ITCs on eligible expenses. It can save costs by decreasing the time spent on tax preparation and record-keeping. For small business owners who outsource their bookkeeping or tax preparation tasks, this can translate into lower accounting fees.

- Reduced risk of penalties or interest charges: With fewer calculations and a more straightforward process, the HST Quick Method minimizes the likelihood of mistakes in HST remittance, which can help businesses avoid potential penalties or interest charges resulting from inaccurate tax reporting.

- Improved cash flow: Since the Quick Method HST rate is lower than the standard HST rate, businesses may retain more of the HST they collect on sales, improving their cash flow. However, this also means they cannot claim the total amount of ITCs on their expenses.

The tax rate for the HST Quick Method

The tax rates for the HST Quick Method vary based on the type of business and the province in which it operates.

Generally, CRA divides all businesses into two categories:

- Businesses that provide services, such as parcel couriers, laundry specialists, automotive maintenance centers, fast-food establishments, domestic cleaning providers, event food suppliers, painting professionals, photo artists, and independent IT contractors

- Businesses that purchase goods for resale, such as vintage merchants, food markets and corner shops, creative supply outlets, unique clothing and specialty shops, fueling stations (gas)

The tax rate differs depending on the province where the business is established and where it provides services.

HST Quick Method rates for businesses that provide services depending on province:

| Your location (where GST at 5% applies): Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Saskatchewan, Yukon | Your location (where HST at 13% applies): Ontario | Your location (where HST at 14% applies): Québec | Your location (where HST at 15% applies): New Brunswick, Newfoundland and Labrador, Nova Scotia, Prince Edward Island | |

| Your client/supplies location (where GST at 5% applies): Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Saskatchewan, Yukon | 3.60% | 1.80% | 1.60% | 1.40% |

| Your client/supplies location (where HST at 13% applies): Ontario | 10.50% | 8.80% | 8.60% | 8.40% |

| Your client/supplies location (where HST at 14% applies): Québec | 11.30% | 9.60% | 9.40% | 9.20% |

| Your client/supplies location (where HST at 15% applies): New Brunswick, Newfoundland and Labrador, Nova Scotia, Prince Edward Island | 12.00% | 10.40% | 10.20% | 10.00% |

HST Quick Method rates for businesses that purchase goods for resale depending on province:

| Your location (where GST at 5% applies): Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Saskatchewan, Yukon | Your location (where HST at 13% applies): Ontario | Your location (where HST at 14% applies): Québec | Your location (where HST at 15% applies): New Brunswick, Newfoundland and Labrador, Nova Scotia, Prince Edward Island | |

| Your client/supplies location (where GST at 5% applies): Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Saskatchewan, Yukon | 1.80% | 0% (and 2.8% credit) | 0% (and 3.4% credit) | 0% (and 4.0% credit) |

| Your client/supplies location (where HST at 13% applies): Ontario | 8.80% | 4.40% | 3.90% | 3.30% |

| Your client/supplies location (where HST at 14% applies): Québec | 9.60% | 5.30% | 4.70% | 4.20% |

| Your client/supplies location (where HST at 15% applies): New Brunswick, Newfoundland and Labrador, Nova Scotia, Prince Edward Island | 10.40% | 6.10% | 5.60% | 5.00% |

HST Quick Method tax credit from the first $30,000 of revenue

Using the Quick Method to calculate your HST return, you can apply for a 1% tax credit on the first $30,000 of revenue from eligible supplies. To include this credit in your net tax calculation, add it to line 108 if filing electronically or line 107 if filing a paper return. Remember to also account for any other adjustments required to determine the net tax for the reporting period, such as GST/HST included in bad debts from non-eligible supplies.

Here are two examples to help clarify the Quick Method tax credit calculation:

Example 1: Let’s say you have a quarterly HST reporting period, and your revenue for the first quarter is $10,000. In such a case, you can claim a tax credit of 1% on that amount, which equals $100. In your second quarter, you can continue to claim the tax credit up to a maximum of $300 (1% of the first $30,000).

Example 2: Let’s say your HST reporting period is quarterly, and your revenue for the first quarter is $40,000. In such a case you can only claim the tax credit on the first $30,000 of revenue. Which gives you a maximum tax credit of $300 (1% of $30,000). In the following tax periods, you can no longer claim this credit.

Switching between HST Quick and regular method

Once you switch to the HST Quick method, you can continue using it until your annual income exceeds $400,000 or your business no longer meets the eligibility criteria. However, if you want to switch from the Quick Method to the Regular Method, you have to wait for at least one year. Your HST election is valid for at least one year, so you must use the Quick Method before switching to the regular one.

If you want to switch back to the Quick Method after using the regular Method, you’ll need to make a new election with the CRA. You can use Form GST74, which is the same form used for the initial election, to make this new election.

Before changing between the HST Quick Method and the regular Method, consulting with a tax professional is a good idea. Our accounting firm can help you understand the implications and requirements associated with each Method, ensuring you make the best decision for your business.

HST and foreign income

When it comes to HST and foreign income, the key factor to consider is the type of supply and the recipient’s location. Generally, if you provide goods or services to customers outside of Canada, the supplies may be considered “zero-rated.” They are still taxable, but you charge 0% HST on the supplies.

For businesses using the HST Quick Method, the same rules apply. You would not charge HST on these zero-rated supplies when providing goods or services to non-Canadian customers.

However, it is important to remember that not all foreign supplies are zero-rated, and specific rules apply based on the type of goods or services you provide. You better talk with your accountant to know if you have to charge HST your clients and in which cases.

Do you need an HST account if all your suppliers are foreign?

If you’re interested in whether you need to register for an HST account when all your suppliers are located outside of Canada and your revenue is over $30,000 (a situation often faced by IT professionals providing services to US customers), the answer is yes, you do need to register for an HST account. In this case, you need to charge 0% HST on your zero-rated supplies to US customers, and you are required to file HST returns.

In such cases, we advise our clients to refrain from using the Quick Method of HST accounting, as they cannot claim Input Tax Credits (ITC). Instead, they would benefit more from using the Regular Method of HST accounting.

It is always a good idea to consult with a tax professional or refer to the Canada Revenue Agency’s guidelines to ensure compliance with HST regulations and determine the correct treatment of your foreign income.

What are the disadvantages of using the Quick method of HST?

While the Quick method simplifies the HST calculation for small businesses in Canada, there are several disadvantages to using this method:

- Reduced input tax credits (ITCs): When using the Quick method, businesses cannot claim full ITCs on their expenses. It could result in paying more HST than necessary, especially if the company has significant expenses that would otherwise be eligible for ITCs.

- Limited applicability: The Quick Method may not benefit businesses with a high proportion of zero-rated or exempt supplies, as the standard HST calculation might result in lower net tax payable.

- Inaccurate representation of business performance: The Quick Method can sometimes distort the amount of HST collected and paid, making it harder to analyze the business’s financial performance.

- Complexity in mixed supplies: For businesses that deal with a mix of taxable, zero-rated, and exempt supplies, the Quick method can be more complicated to apply, potentially negating its simplicity.

- The requirement to opt-in: Businesses need to make an election to use the Quick method, and this decision is binding for at least one year. If a business realizes that the Quick method does not provide benefits, it must wait until the next fiscal year to switch back to the Regular HST method.

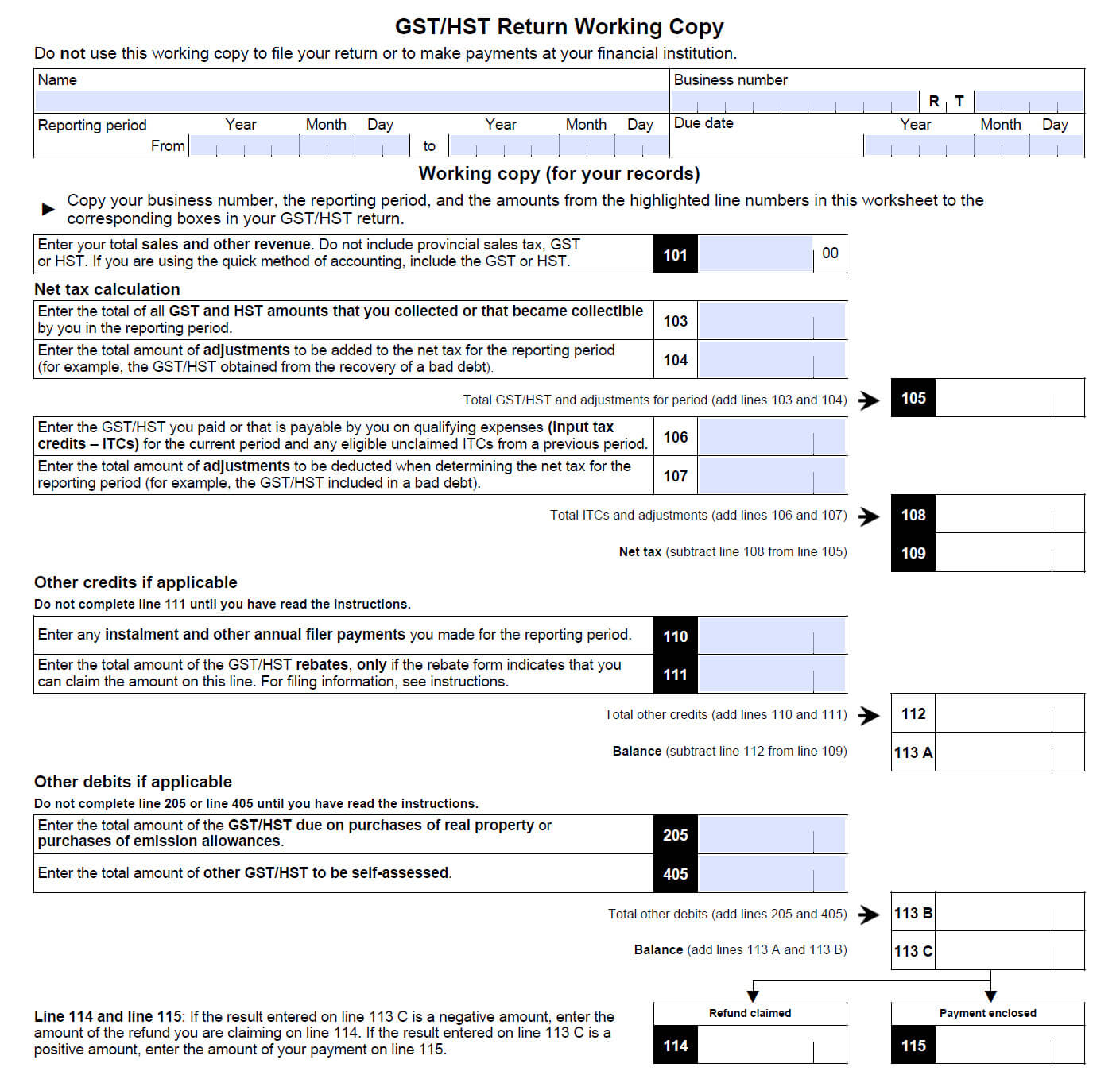

GST/HST Calculation form

See the PDF version of the GST/HST calculation form below. It is easy to calculate your GST/HST return using that form. The form has instructions on how to fill it out, but if you need more information or examples, feel free to use the instructions from CRA.

DOWNLOAD THE GST/HST CALCULATION FORM.

You can use the above form to calculate your GST/HST return.

Frequently Asked Questions (FAQ)

What does the term "supplies" refer to in HST?

In the context of the HST, “supplies” refers to the goods and services sold, leased, or otherwise provided by a business. Supplies can be taxable or non-taxable, depending on their nature and the specific tax rules that apply.

For HST purposes, supplies are typically categorized into three main types:

- Taxable supplies: These include most goods and services provided in Canada, on which HST is charged at the applicable rate (5%, 13%, or 15%, depending on the province).

- Zero-rated supplies: These are specific goods and services on which HST is charged at a 0% rate. Examples include basic groceries, prescription drugs, and specific medical devices, as well as exports of goods and services to non-Canadian customers.

- Exempt supplies: These are goods and services not subject to HST, meaning no tax is charged on them. Examples include most health, educational, and financial services.

What is "real property"?

In the context of claiming Input Tax Credits, “real property” refers to land and anything that is permanently attached to or built on the land. It includes buildings, structures, and other fixed improvements made to the land. Essentially, it is a property that cannot be easily moved or relocated.

When claiming Input Tax Credits for real property, you can include expenses related to purchasing the property and any improvements made to it, such as renovations, expansions, or upgrades.

What is "capital property"?

In the context of claiming Input Tax Credits, “capital property” refers to long-term assets that a business acquires or improves to generate income and are not intended for resale. Capital property excludes real property (land and buildings) but includes machinery, equipment, vehicles, furniture, and computer systems.

When claiming Input Tax Credits for capital property, you can include expenses related to purchasing the capital property and any improvements made. These expenses are typically considered capital expenditures and are subject to depreciation over time for accounting and tax purposes.

Get a Professional help today!

Don’t leave your small business’s tax savings to chance! The HST Quick Method can be a game-changer for your financial success, but it’s essential to get it right. Our expert accountants are here to help you navigate the complexities and ensure you maximize your benefits. Contact us today for a consultation, and let us confidently and efficiently guide you through the HST Quick Method. Don’t wait – your business’s financial future is just a call away!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Anna Grigoryan is a professional corporate accountant who provides accounting, bookkeeping and tax services to Small Business owners and individuals. She has more than ten years of professional experience in public accounting and a bachelor’s degree in Business Accounting. Anna is the CEO of Taxory, an accounting firm in Toronto area.